UFDS has new members of the Assembly of Delegates. Here you can meet three of them.

Following April's annual general assembly of the Danish Shipowners’ Accident Insurance Association, the Delegate Assembly was joined be new members in the form of Tine Kaaber of Svitzer, Steven Sandorff of DS NORDEN and Hans Thorsen of Uni-Tankers Denmark.

We have spoken to all three about their respective backgrounds, expected contributions to the Assembly and their views on future developments in the field.

Tine Kaaber, Head of Insurance & Risk Management, Svitzer A/S

How would you describe your background in the maritime/insurance profession?

I am a freight forwarder by education and have +25 years of experience with insurance, claims and risk management. I’ve always worked in or for international logistics companies. Since 2017, I have had the overall insurance responsibility in the groups in which I have worked. Through this, I have built up a solid experience with global and local insurance programs of industry-specific and general insurance to cover the company.

In October 2024, I joined Svitzer A/S as Head of Insurance & Risk Management with responsibility for, and building up, the global insurance department. A role where I draw on my experience and strong network.

The experiences and insights that I have built up over the past +25 years I take with me into the role of delegate.

What will you contribute as part of the Delegate Assembly in UFDS?

I bring with me a solid professional background as well as a strong insurance background, by virtue of my many years of experience in logistics and marine insurance. I naturally take this with me into the role as delegate at UFDS, where I look forward to contributing actively with both a high level of professionalism and a great understanding of the industry.

Furthermore, I see it as a strength that I have worked on both the underwriting and claims side, which means that I have an understanding of how an insurer take out risks on the one hand, and how the policy covers when an accident occurs on the other.

I am curious and challenge the frameworks/companies I am a part of. This is achieved not only by continuing what works, but also by continuously asking questions, thinking innovatively and adapting to the changes that are taking place in the industry and the insurance market. If we don't, we lose innovation.

What development trends do you see in the UFDS area that the company should be aware of?

Although I am still new in my role as a delegate in UFDS, I am sure that with my strong background, I can contribute valuable input to UFDS. I will use my first time to immerse myself so that I can translate my knowledge and experience into concrete contributions. I look forward to sharing my observations and perspectives.

Steven Sandorff, Senior Advisor, Dampskibsselskabet NORDEN A/S

How would you describe your background in the maritime/insurance profession?

I started my career at sea as a mess boy in 1977, continued as a mate trainee at A.P. Møller – Maersk in 1978 and graduated from Svendborg Navigation School as a master in 1983.

After that, I sailed as a deck officer on general cargo ships, container ships, tankers, passenger ships, RoRo and heavylift/project vessels at A.P. Møller, DFDS, Dannebrog and Elite Shipping, and then I got my first command as captain in 1995.

I have also served as a lieutenant in the Danish Navy, on top of which I have worked occasionally as a supercargo, i.e. the charterer's representative on a ship. Finally, I was a maritime expert within the Danish legal system for a number of years.

In 2000, I went ashore and became Head of Tank Operations at Dampskibsselskabet NORDEN A/S. For more than 15 years, I was involved in the establishment of the Norient Product Pool, where in addition to my tasks in the Nordic region, I also headed the Operations department.

Since then, I moved on to other positions in the company and have, among other things, been in charge of the nautical department and been involved in outsourcing technical management. Today, I am responsible for taking out both marine and non-marine insurance for the company, and I am involved in some areas of claims handling.

What will you contribute as part of the Delegate Assembly in UFDS?

Throughout my 25 years in NORDEN, I have always been very focused on ensuring that all parties work together to optimize daily operations. This includes, in particular, that commercial, technical and other land-based personnel groups, as well as masters and external contractors, are all consulted and involved when it comes to making the necessary decisions.

I will bring that mindset with me into the delegate assembly – where we also come from many different places in the Danish shipping industry – so that everyone feels involved as much as possible, and we can come to the right decision on that basis.

What development trends do you see in the UFDS area that the company should be aware of?

I would like to point out the fact that many Danish shipping companies, as owners of Danish-flagged vessels obliged to follow Danish maritime legislation, have delegated the manning of primarily foreign seafarers to foreign crewing companies.

These rarely have the full insight into the Danish rules or Danish shipping culture, including the handling of accident cases. Therefore, it is important that UFDS, among others, understands how to communicate the information to others than the Danish companies they have been used to working with for many years.

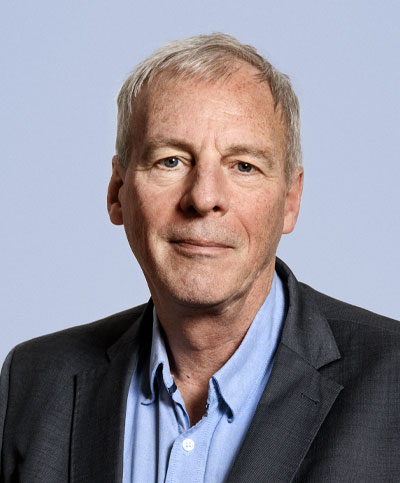

Hans Thorsen, Managing Director, Global Operations, Uni-Tankers Denmark

How would you describe your background in the maritime/insurance profession?

I am commercially trained in shipping in chartering and operations in Herning Shipping, completing in 1996, after which I became a permanent shipbroker. In 2000, I was asked if I would like to open a satellite office for the company in Cannes in the south of France, which I said yes to.

I ended up being down there for almost 16 years, first in Herning Shipping until 2012, after which I switched to Uni-Tankers to start up their French office. At the end of 2015, I returned home to Denmark and became COO of what was then called Uni-Chartering, which was a 100 percent owned subsidiary of Uni-Tankers. Later, the two companies merged, and I got my current role.

Two years ago, I was offered to take over the insurance area from a colleague who was retiring. After a six-month handover, I have had sole responsibility, so I’m still relatively new to the field, but I have gradually gained a good overview, and the insurance market is in many ways similar to the other markets I have dealt with; It is supply and demand that rule.

My main focus is on the insurance part of our ships, i.e. P&I (Protection and Indemnity, ed.), FD&D coverage (Freight, Demurrage and Defence, ed.), and then on the entire hull area. In addition, there is UFDS and everything we call non-marine, which is actually handled by some other parts of the group.

What will you contribute as part of the Delegate Assembly in UFDS?

In Uni-Tankers, we have a large number of ships flying the Danish flag, crewed by Danish seafarers, so it’s very relevant for us to be represented in the delegate assembly, and I look forward to becoming part of the group.

My insurance experience is obviously not that extensive, so I will probably need some time in the beginning to get to know everything a little better, but that said, I have a lot of other maritime experience I can draw on.

What development trends do you see in the UFDS area that the company should be aware of?

The shipping industry as a whole faces some huge challenges in the coming years in relation to the green transition, and in this respect also fleet renewal. And this applies to virtually all the shipping companies, which in the long term will have to find something else to sail on than conventional bunker oil.

This will place some different – and new – demands on the crews of, for example, dual fuel ships, which must also be able to handle methanol and perhaps ammonia. This presents some other operational risks on board that we have to deal with. So, there are many exciting perspectives on that front.